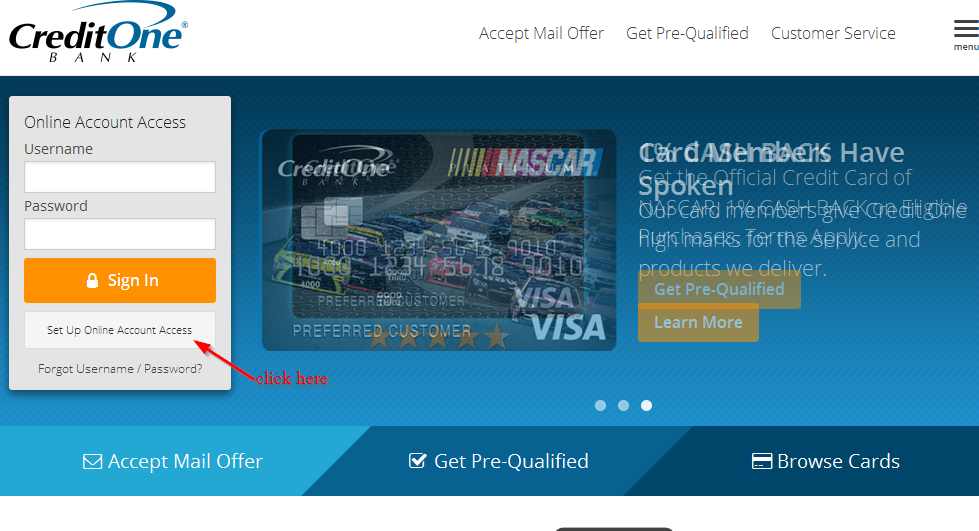

Use your card a little, pay it off each month, build up your score a little each month. I HIGHLY recommend Credit One.and being responsible to rebuild your credit. Yes, they're overseas-but polite and always willing to work with me if I need something, including waiving fees when there's a good reason. I monitor my account through the phone app, make payments there.and when I need to talk to a live rep I've never had an issue. I use them both and try to pay them both off each month, building my credit a little at a time-I didn't get bad credit overnight and there's no magic way to make bad credit go away overnight. Since then I've increased the limit on that card to $1,000 and gotten a second "platinum" card with them. They gave me my first unsecured card with a $500 limit when no one else would-everyone else wanted a secured account equal to my credit line. I've read reviews about poor customer service, lack of contact, etc.I've had nothing but a great experience! I've been a Credit One customer for a couple of years now and LOVE them. GREAT option for credit-challenged people Receive alerts if fraudulent activity is suspected on your account Get notified when rewards and exclusive credit card offers are available Set up notifications for important account activity, payment reminders, and special offers

#CREDIT ONE LOGIN FULL#

View a full list of frequently asked questions and answersĬhoose how you get alerts, including mobile notifications, email, and text Use our chat feature for instant answers to your questions View the latest offers and More Cash Back Rewards on purchases at participating merchantsĮasy access to Help & Support contact information

#CREDIT ONE LOGIN FREE#

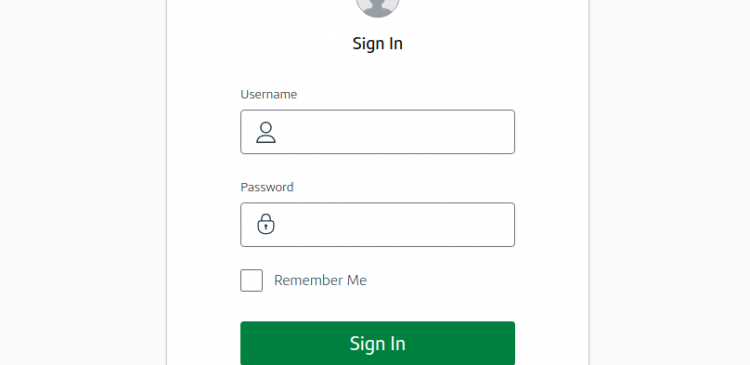

Schedule, edit, or cancel one-time paymentsĬheck your balance and available credit, and view recent transactions or monthly statementsĪccess your Free Online Experian Credit ScoreĮnroll in paperless documents and statements to keep your account information secure and ensure important communications won't get lost in the mail Use Quick View to see a snapshot of your account without signing in Schedule one-time or monthly automatic payments and view account activity, balances, payment history, offers, and more!įast and secure sign-in with Face ID® and Touch ID® (available on capable devices) Paying it off could hurt your score.Conveniently manage your credit card accounts with the Credit One Bank Mobile App.

You may not want to pay 12 Credit One Bank N A debt, especially if it's potentially inaccurate. You likely want to call Credit Glory, first (855) 430-8850. What Is 12 Credit One Bank N A Phone Number?

#CREDIT ONE LOGIN HOW TO#

While these acts seem very complicated, they provide a great deal of power to you if you know how to use it.

12 Credit One Bank N A is governed by the Fair Debt Collection Practices Act (or FDCPA) and the Fair Credit Reporting Act (or FCRA). You have the right to dispute any debt of yours that 12 Credit One Bank N A is trying to collect. What Are My Rights When Dealing With 12 Credit One Bank N A? These are constantly changing, and typically collection agencies, including 12 Credit One Bank N A, do not share publicly who they buy from. Who Does 12 Credit One Bank N A Collect For?ġ2 Credit One Bank N A collects for a variety of lending companies (called creditors). You may also not have to pay at all, and if any issues with the account exist you may have it removed all together (and never have to hear from them again).ĭoes 12 Credit One Bank N A Accept A Goodwill Letter To Remove My Collection/Charge-Off?ġ2 Credit One Bank N A does not accept goodwill letters to remove collection accounts or chargeoffs in our experience, and this is typical. Settling your debt with 12 Credit One Bank N A may help your score, but it may also hurt your score. Should I Negotiate A Settlement With 12 Credit One Bank N A?

You can get your collection completely removed. This means your credit is still affected. The result? Your collections still appears on your report for 7 years (from the date of first delinquency). Paying a debt in collections changes your credit report status from 'unpaid' to 'paid'. Paying off 12 Credit One Bank N A to have credit bureaus delete it from your report seems ideal. Should I Pay For Delete With 12 Credit One Bank N A?

They buy debt from a number of different creditors that have given up on trying to collect the amount themselves (sometimes referred to as a "charge-off"). Is 12 Credit One Bank N A A Debt Collection Agency?ġ2 Credit One Bank N A is a debt collection agency.

0 kommentar(er)

0 kommentar(er)